Our real estate expertise

Crestpoint is a team of professionals with extensive

transaction and asset management experience.

Crestpoint is a team of professionals with extensive

transaction and asset management experience.

Consistently employing an entrepreneurial mindset combined with institutional discipline, Crestpoint collectively manages over $10.2 billion of commercial real estate and debt investments on behalf of institutional and high-net-worth clients.

We offer four principal investment options: the Crestpoint Core Plus Real Estate Strategy, an open-ended pooled mandate with a core-plus investment strategy; the Crestpoint Opportunistic Real Estate Strategy, a closed-ended pooled mandate with an opportunistic investment strategy, and Crestpoint Commercial Debt Strategy, an open-ended pooled commercial debt strategy; along with customized segregated account strategies.

Crestpoint is a team of professionals with extensive real estate investment experience.

At Crestpoint, we aim to deliver optimal risk-adjusted returns throughout all phases of the investment cycle by investing in high-quality, commercial real estate properties and commercial real estate debt across Canada. Subscribing to a philosophy that you must “buy right and manage right” to be successful, our team brings years of transaction and asset management experience to the firm and has established a significant presence within the Canadian commercial real estate industry. Collectively, over the span of their careers, team members have advised numerous Canadian pension funds, REITs and various institutional and private investors, participating in a wide variety of transactions, including acquisitions, dispositions, developments and financings.

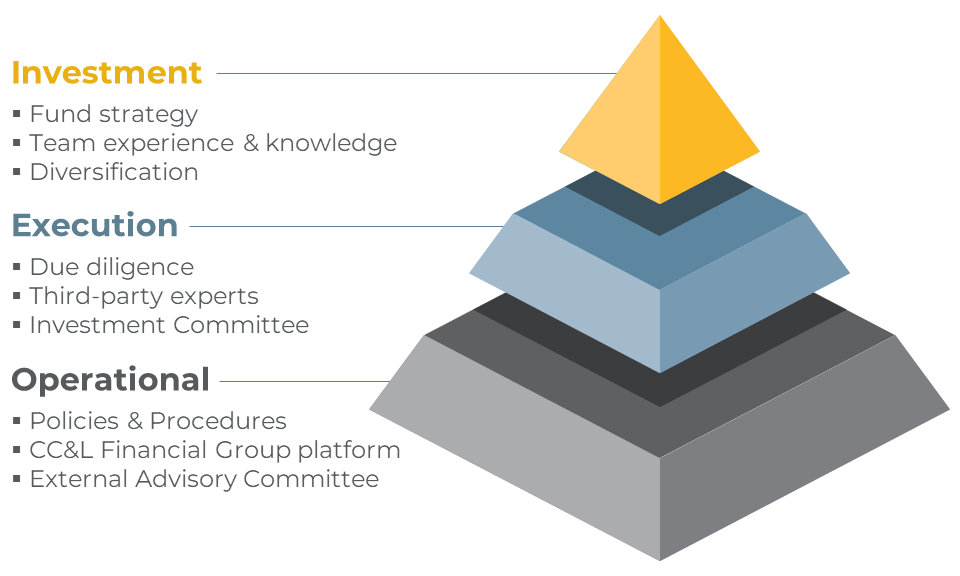

We employ rigorous risk management across all of our investment strategies

We mitigate risk with a fundamental, holistic approach that is fully integrated within our investment process. Our disciplined, objective and thorough approach identifies, measures, prices, mitigates and monitors risk resulting in strong risk-adjusted returns across our strategies.